Shopify Payments Review: The Complete Things You Should Know

You all know about Shopify, but do you know about Shopify payments?

If you don’t, then you have landed at the exact place where you have to be.

These days, Shopify has become a prominent eCommerce solution.

It also has been considered in the top ten list of the best eCommerce platforms.

In this guide, you will know the complete information related to Shopify payments like what are the pros and cons, how to set up, fees, and more.

Apart from this, to run a successful Shopify store, you need a powerful theme that helps your business grow more.

That being said, let’s quickly get into our points.

What Is Shopify Payments?

If you don’t know Shopify Payments, then it is a payment processor that comes built-in in with Shopify.

It is the service that lets you transfer your funds to your bank account which has been paid by your customers.

If you want to use Shopify, then you won’t find any trouble related payment gateway.

You can use its own payment gateway, although there’s nothing like you only have this sole option.

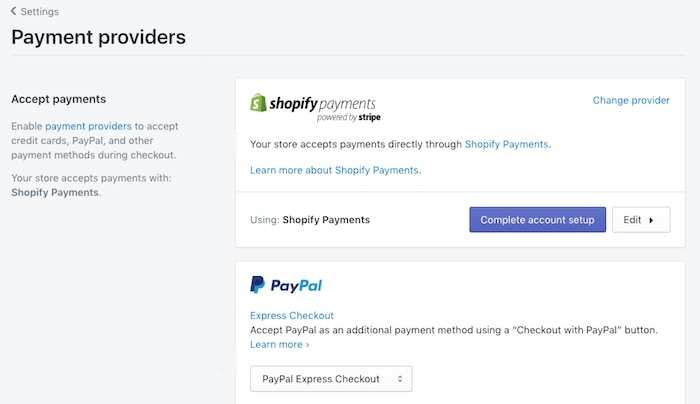

You can definitely use other gateways (third-party), too such as PayPal, Amazon pay, stripe, and more.

One more thing, Shopify payment was developed in partnership with Stripe.

That means, whenever you use Shopify payments, it goes through Stripe.

Yet, you can also set up a different Stripe account to accept your payments.

Shopify payments is surely the easy way to accept payments.

Why Use Shopify Payments?

You also have this question in mind: why should I use Shopify payments, even though there are many other options available, too.

If you don’t want to give your customers Shopify payments, then there are third-party gateways that you can use.

But you have to set up merchant accounts for each gateway you offer to your customers.

This will not be done in minutes. This process takes time.

Moreover, you’ll get one benefit with Shopify payments is that you won’t be charged any additional fees.

However, you will be charged (as a commission) if you use a third-party gateway, which you can see below:

| 2% with Basic Shopify |

| 1% with Shopify and |

| 0.5% with Advanced Shopify |

That’s why Shopify Payments is recommended.

Now, this also doesn’t mean that you solely have to rely on Shopify payments, though you can definitely use other gateways, too.

Using other gateways builds TRUST among your customers that make them purchase on your site.

There are many yet renowned payment gateways out there to consider such as Amazon pay, Stripe, PayPal, Authorize.net, and more.

People have different choices, so it’s okay to give them other options as well, to make their shopping experience seamless.

How Do Shopify Payments Work?

For most merchants, Shopify Payments just works like magic.

It is IDEAL for those who want a convenient, omnichannel platform that includes accepting international currencies with automatic currency conversion.

Moreover, Shopify payments does its all operations in Real-time which means merchants can track the record of every single penny.

Unlike the other gateways like PayPal where you have to be logged in to check all the transactions.

You can check out all the payouts right from your dashboard. Also, you can see which payment mode has been used in each transaction.

However, the payday depends on the country from where you operate your business.

Some specific countries have to wait for at least 3 days which are Canada, UK, Spain, Australia, New Zealand, and more.

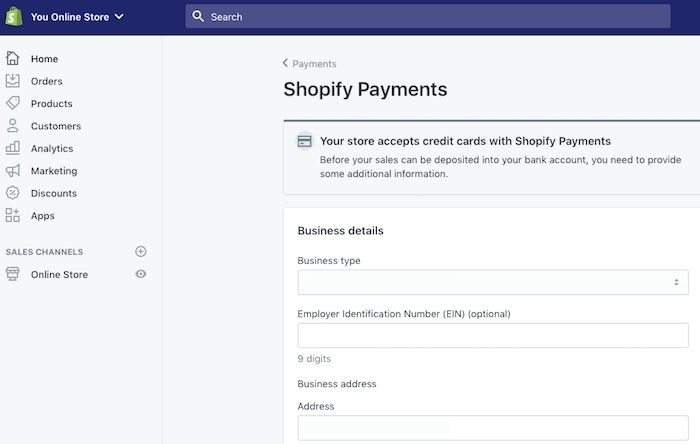

How To Set Up?

The setup is pretty easy and quick.

In order to accept your payments via Shopify payments, you have to perform a few steps to set it up.

Go to the Shopify dashboard, then go to the ‘Settings’ and select the ‘Payment Providers’ option.

Now just finish the “Shopify Payments setup” process.

You are also required to add product information, bank details, and your personal data.

It has been said that a Shopify Payments account needs to be completely set up within 21 business days after the first sale transaction.

If you don’t take any action, then the buyer will receive a refund of all payments made to the store owner.

Definitely, you don’t want that to happen to you.

That’s why you need to complete this setup as quickly as you can do, better for your prospective transactions.

What’s more important in this process is your bank account, which must comply with local banking regulations.

Shopify can, however, terminate your account at any time if you violate their terms of service.

Are Credit Card Payments Accepted With Shopify?

Yes.

You can accept all major credit card payments with the Shopify payment gateway.

But the transaction fees will depend on the Shopify plan you have.

The higher plan you choose, the lower your fees will be.

Below are the fees for credit card payments:

| Plan | Monthly Cost | Per Transaction Fees |

|---|---|---|

| Shopify Lite | $9 | 2.9% + 30¢ |

| Shopify Basic | $29 | 2.9% + 30¢ |

| Shopify | $79 | 2.6% + 30¢ |

| Shopify Advance | $299 | 2.4% + 30¢ |

| Shopify Plus (enterprise plan) | $2,000 | 2.15% + 30¢ |

All businesses worldwide accept debit and credit cards from Visa, Mastercard, and American Express.

Additional Fees:

When customers issue the chargeback, Shopify payments charge a flat-rate fee for each chargeback.

There’s nothing like only Shopify does this, other gateways too take chargeback fees.

The chargeback fees vary by country.

In Canada, it’s $15 which is also the same in the USA.

However, this is the industry average (you can check the complete list of chargeback fees by country).

Shopify says that, if you win the chargeback, then you’ll get the disputed sum back, and the chargeback fee will be refunded from Shopify.

Besides, on its payments service, Shopify does not charge any EXTRA monthly fees, payment protection fees, secret fees, or setup fees.

Shopify receives an excellent rating in this category because we believe it provides excellent value and has a pricing structure that allows for flexibility and development.

The Limitation of Shopify Payments

Despite being a popular platform, it has some limitations, too.

The most common problems you’ll face are holding processed funds and closing accounts.

So you need to first read the terms of services before taking any step, you also need to make sure that the products you sell aren’t prohibited businesses.

If you don’t want to see the red flag for your company, then take precautions to avoid getting into that situation.

There are some additional issues related to Shopify payments like:

You’ll need a Shopify higher plan if you want to connect a receipt printer or barcode scanner.

Also, if you want to add staff accounts, you also need to check the pricing plans beforehand.

Now Let’s check out some of the pros first of Shopify Payments:

Pros:

- When you have an active Shopify merchant account, you’re privileged to monitor all the transactions and profit margins.

- Yet you can also do the same on other gateways as well but the only difference with Shopify is that you get the seamless experience.

- You can’t go wrong with Shopify payments when it comes to integration, because you get all the actions via the admin dashboard.

- There are no additional transaction fees which is great. So you can undoubtedly go with the Shopify payments.

- With Shopify Payments, you can optimize your conversions and consequently help reduce bounce rates.

- The processing fees with Shopify are extremely lower than other gateways out there.

- Moreover, if you use Shopify’s advance plan, then the fees are yet more lower than the regular Shopify plan.

- When it comes to security, Shopify payments won’t let you down for sure.

Cons:

- There are chances that Shopify might hold your funds, there are a number of reasons for that. And there’s no guarantee about how long they would hold.

- There are also chargeback fees from Shopify. And there are also many chargeback claims going on from some dishonest customers.

What’s more dangerous?

- The most important thing about Shopify is that Shopify can terminate your account without giving you any prior notice.

Eligible Countries

Before choosing Shopify payments, you should be aware of how many countries the gateway supports.

Currently, Shopify supports this list of countries.

Use a different payment processor if Shopify payments is not available in your country.

Furthermore, Shopify can also prohibit your business from using Shopify payments.

What type of businesses could be?

Businesses like security brokers, real estate opportunities, mortgage consulting services, and more.

Nevertheless, there are currency exchanges, check cashing, and wire transfers.

And last but not least, virtual currencies include Bitcoin, digital wallets, and cryptocurrency mining equipment.

Shopify Payments vs Other Payment Gateways

As I mentioned above that there are tons of other payment processors out there that Shopify supports.

So it’s obvious that there are advantages and disadvantages as well of having other modes of transaction.

Here we are adding why Shopify payments have an extra edge over other processors?

However, we also have created a list of Shopify alternatives for those who prefer other platforms over Shopify.

Let’s quickly see what perks Shopify has over other gateways.

1. Chargeback Recoveries:

Chargebacks are very much familiar with Merchants. Because merchants have to deal with this from time to time.

Why is this so?

Now, if you don’t know what chargebacks are then let us tell in very simple words.

Let’s say if someone has made a purchase from your store with a credit card, and then he/she wants to cancel that transaction.

That’s where the chargeback comes.

A chargeback is a request for money back into the consumer’s account from the merchant’s.

In this condition, if you have made a transaction via PayPal and want your money back, then you have to give additional proof about the transaction.

But the thing is different with Shopify.

Here the support is optimum, consumers can directly inquire about the chargebacks straight from the Shopify dashboard.

Shopify offers more detailed responses to every order.

Now here’s a thing you need to understand is that when a customer’s bank sends you a chargeback, it also sends it with a processing fee.

Shopify will pay this processing fee if a chargeback is resolved in your favor otherwise, you have to pay.

2. Prevent Redirect At Checkout:

There is no point in adding unwanted extra steps to the checkout page, which reduces conversion rates.

The good thing with Shopify payments is that it streamlines the whole checkout process which becomes very intuitive for consumers.

This helps boost conversions and leaves a happy shopping experience.

3. Real-Time Tracking:

There’s nothing out of the box thing, any payment processor can track the sales and revenue.

However, the advantage of Shopify is that you can get all the information directly from its dashboard.

It eliminates the requirement of remembering the passwords and extra clicking to get the financial info.

What Are The Drawbacks?

When there are advantages, then there are disadvantages, too.

Big payment processors such as Paypal and Stripe have some quality over Shopify Payments.

When it comes to chargebacks, then Stripe offers robust protection than Shopify payments gateway.

You can pay an extra 0.4% per transaction fee to cover any disputed amount of money and ignore fees.

Moreover, adding a PayPal payment gateway to your website builds trust because PayPal is a big name in the world of payment gateways.

Technical Support

When it comes to the customer service, Shopify has an in-house support team that manages customers’ queries and Shopify payments issues right from the Shopify platform.

One great thing about Shopify is that whenever you come across a problem anywhere in the world, you’ll have the solution from Shopify’s 24/7 customer care.

Furthermore, you may get assistance through a variety of sources such as live chat, email, or a qualified professional who responds in minutes.

Let’s have a look at each of these options listed above:

Email:

In Email support, you can reach out to Shopify’s Shopify gurus or the Shopify Billing department via email.

Phone & Live Chat:

Another great option to use is live chat. You can live chat with Shopify’s support executive at any time.

You can even connect a call to speak with a representative.

Online Knowledgebase:

You’ll find plenty of Knowledgebase guide related Shopify payments.

User Forum:

There are user forums, too, where you can ask questions to fellow merchants and in return you get answers from users and sometimes from Shopify representatives.

Speaking of the customer review, there are mixed behaviors in the reviews department with some users receiving positive responses while others do not.

Last Words On Shopify Payments

It’s really essential for a merchant to create a positive and happy shopping experience for their customers.

But this is not enough, you also need to leverage a secure and reliable payment processor that gives you fast access to your money.

That being said, Shopify payments is a quick and easy tool for both you and your customers.

Shopify Payments is best for easy setup, POS integration, and straightforward management that won’t let you down.

When it’s time to scale up, the platform allows more versatility and cost-efficiency.

Still, if you don’t want a Shopify, then check out our list of best Shopify alternatives that might work for you.

I hope you get all the information related to Shopify payments in this guide.

if you did get it, then do share a few words with us in the comments.